Whether you’re interested in buying or selling shares of GameStop stock, you should learn about the company’s history, business model, and financial outlook. Then, you’ll know if the company is worth your investment.

Low interest rates

Whether or not low-interest rates are the reason for the recent GameStop stock trading episode is hard to say. However, the company is operating in a down market. Its cash burn appears to be linked to external factors, such as supply chain disruptions. As a result, the company’s free cash flow per share in the last quarter was the lowest in a decade. This will likely lead to more margin-crushing markdowns and a more comprehensive net loss.

The company is operating in a down market, but its cash hoard should provide some protection. In addition, the company’s debt-to-equity ratio is manageable at 1.1. Despite this, GameStop may run out cash as early as next year.

The company’s cash burn is expected to slow down in the coming quarters. However, the company still has almost $1 billion in cash.

The high degree of leverage

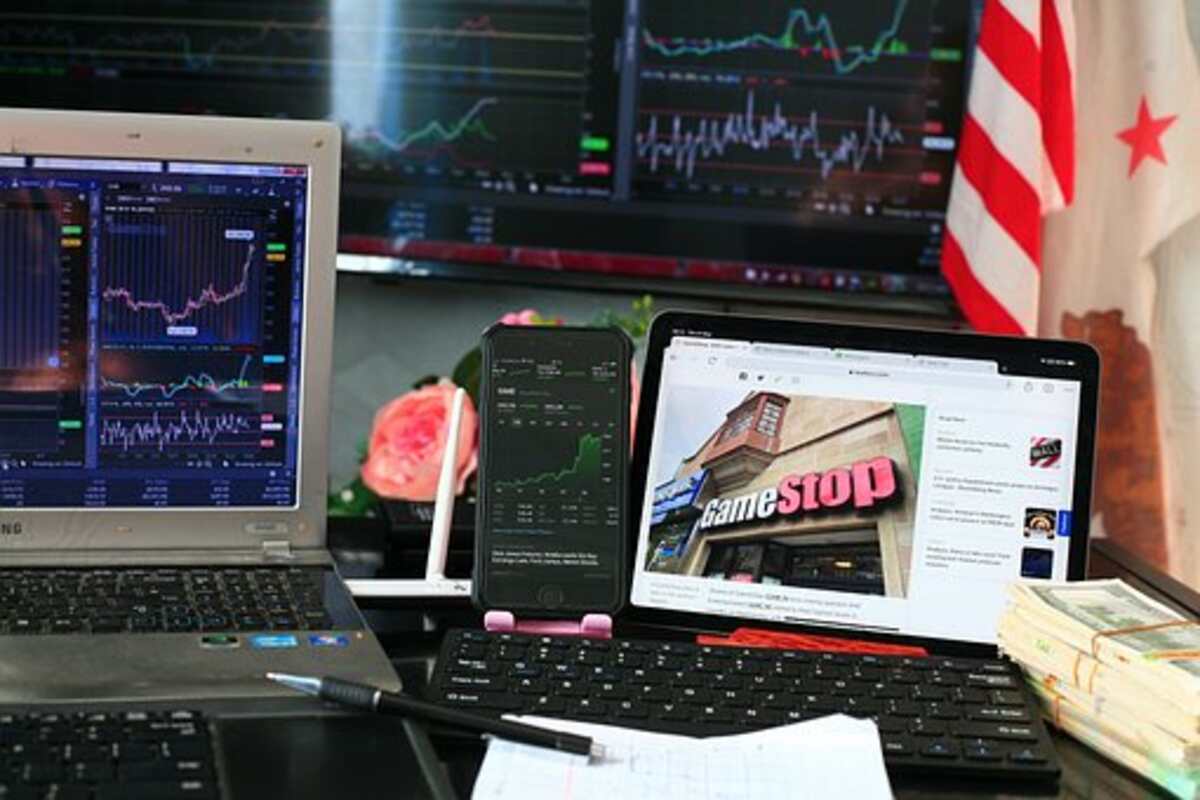

During the last four months, GameStop stocks have been on the volatile side. In the past few weeks, investors have made significant gains. However, the store has now cut its payments for the week to under 200%. Its shares are expected to fall again, though.

This is not the first time a company has experienced a stock price runup accompanied by significant volatility. However, GameStop and AMC Holdings have exhibited dramatic risk and motivation in their runups.

As a result of this risk, some investors have targeted the stocks of AMC Holdings and GameStop. While both companies have gained significant amounts of money, the gains have been extraordinary.

One of the reasons for the GameStop stock runup was the Reddit subreddit’s “short-squeeze.” This is a term referring to a situation wherein many people, most of whom aren’t familiar with the company, buy the stock hoping the price will rise. The store eventually grows, but the short seller must repurchase the store to avoid a loss.

Market manipulation

Whether or not GameStop’s stock market manipulation was legal is a topic of debate. However, aeveral lawsuits have been filed in the aftermath of the sudden stock price spike.

The question is whether the GameStop episode will be the tip of the iceberg regarding regulation and transparency. The issue of how effectively individual investors and institutions can participate in the stock market is a topic of debate that will likely remain for a while.

Market manipulation is a broad term that encompasses many different actions. It could include buying shares to drive up prices or targeting other traders. Detecting manipulation is often a matter of tracking down people exerting an impact on the market.

The GameStop episode is the perfect storm of events. Its origins were tied to a massive increase in trading volume, a short squeeze, and several other factors.

Subreddit r/WallStreetBets

r/WallStreetBets is a Reddit subreddit devoted to stock trading and options trading. It has a user base of primarily amateur investors. It has a rivalry with r/investing.

The WSB subreddit is famous for its unique slang and offensive terms. It is also known for its use of meme stocks. These are stocks with no intrinsic value. They are used to express confidence in a stock’s rise or decline.

The Reddit community of r/WallStreetBets has grown to millions of subscribers. According to WallStreetBets, the subreddit was created by Redditor Jaime Rogozinski. The term “autist” is common for members of the WSB community. Unlike other stock market-related subreddits, r/WallStreetBets members have an unusual investing style. They have a clear financial goal but are also cynical about long-term investment advice.